About that 95% effective vaccine… (part 1)

Image courtesy of Adobe Stock.

The Covid vaccination is 95% effective against infection.

That is what we were told by every public health official and media outlet in order to persuade us to get the shots.

95%.

It has been so effective we should get a booster. And another booster. And now there is a brand new fifth booster, because the previous four worked so well.

This is the first in a series of posts explaining the effectiveness statements were not only false, but were known to be false at the time.

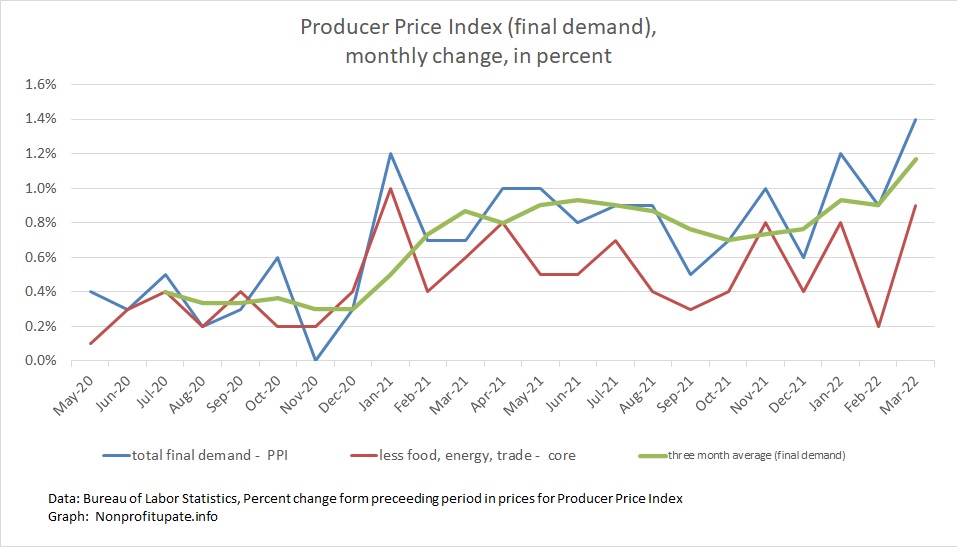

We start with a survey of how incredibly effective the vaccine has been in 2022:

CDC director

10/31/22 – Center for Disease Control – Update on CDC Director and COVID-19 – I cannot describe this more lastingly than merely quoting the straight line offered by the CDC press release:

(more…)