economic freedom

Supply chain disruptions not getting better anytime soon.

String of articles are pointing at disruptions in the supply chain continuing well into 2022 or possibly 2023.

A few of said articles discussed below:

- Tally of ships off the Long Beach and Los Angeles ports rises to record of 111.

- Experienced truck driver describes how every step of the trucking part of the supply chain is tangled up, from extra wait getting into the port all the way to several hours waiting to drop cargo at warehouses.

- Disruption of chip supply expected to last until sometime in 2023.

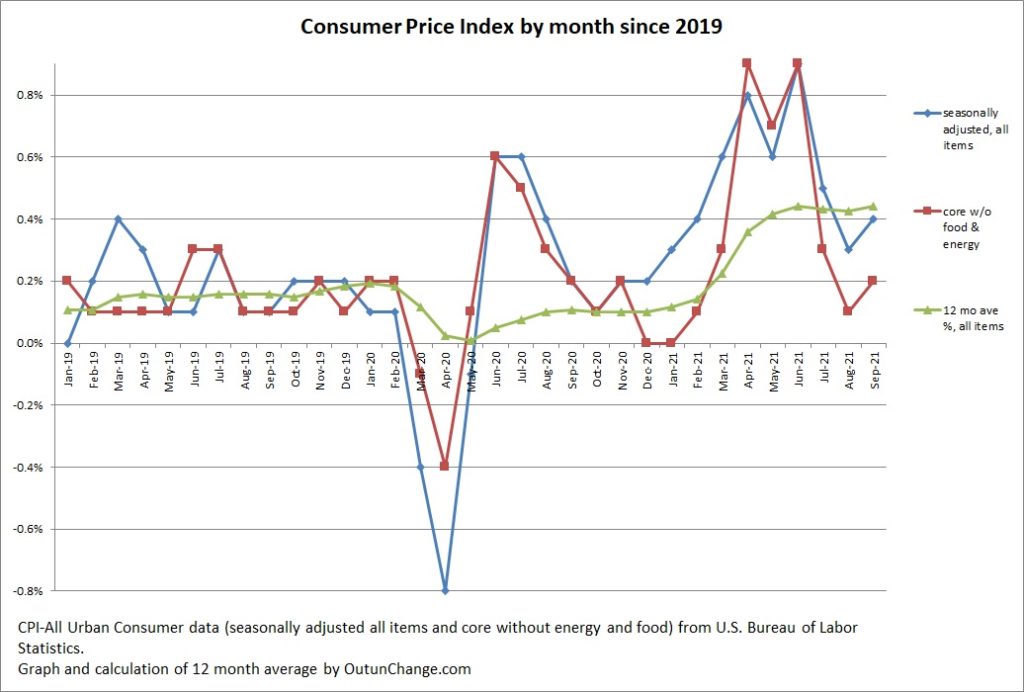

Do please keep in mind this is due to the hubris of government officials thinking an economy can be turned off and on light a light switch and also flooding the economy with several trillion dollars without any corresponding increase in output.

Washington Free Beacon – 11/10/21 – Record Number of Ships Stranded Outside California Ports – Article sites Business Insider as saying there are 111 ships waiting to unload at Los Angeles and Long Beach ports as of 11/9/21. This backlog is new high from previous record of 108 ships on 10/21/21.

(more…)